A different type of risk

In the next Module, we will introduce you to a comprehensive method of risk identification, analysis, and management as part of the project planning process.

Indeed, you may already be familiar with qualitative techniques, such as the probability/impact matrix, or even more advanced statistical models.

If that is you, park that knowledge for now.

At the project initiation stage, we are more interested in the relative risk to the sponsoring organization of proceeding with an opportunity.

It is therefore important that we assess each opportunity against a set of risk criteria that are predefined from that organization’s perspective.

Given, too, that we will be undertaking a detailed risk-to-the-project analysis as part of our project planning, doing so in the project initiation stage would be both redundant and unnecessary for those opportunities we end up discarding.

So, what are the risks typical to a sponsoring organization that we should consider?

| PROJECT COST | ||

|---|---|---|

| LOW RISK | MEDIUM RISK | HIGH RISK |

| Less than 5% of our program budget | Between 5-15% of our program budget | Greater than 15% of our program budget |

| ±10% confidence in the cost estimate | ±25% confidence in the cost estimate | Greater than 25% margin of error assumed in the cost estimate |

| Expected costs are fully allowed for in the annual budget or financed by the client | Expected costs are partially allowed for in the annual budget or financed by the client | Expected costs are neither allowed for in the annual budget nor externally financed |

The cost of an opportunity (assuming we realize it as a project) is perhaps the most obvious risk to an organization.

The more money it invests in a project, the more it stands to lose if things go wrong; therefore, more expensive projects present a higher risk to the sponsoring organization.

Most organizations use actual dollar amounts relative to the scale of their operations instead of percentages when setting their cost-risk thresholds.

For example, a high-risk project (from the cost perspective) to a community sports club might be one with a budget greater than $10,000, whereas a high-risk opportunity for Microsoft might be any investment greater than $10,000,000.

Confidence in a cost estimate refers to how likely it is that the project will achieve its budget.

A project with a large margin of error assumed in its cost forecast will present a much higher risk to an organization than a project with a tight estimate. This is because when margins of error are high, costs could significantly overrun.

You can determine the margin of error by taking the midpoint of the cost estimate range and seeing the percentage under and over the best- and worst-case cost estimates.

Finally, an opportunity that – when costed – is fully funded by a pre-allocation in the organization’s budget is much lower risk than a project we need to find the money for elsewhere.

| PROJECT TIME | ||

|---|---|---|

| LOW RISK | MEDIUM RISK | HIGH RISK |

| The project can be delivered in less than 3 months | The project can be delivered in less than 6 months | The project will take more than 6 months to deliver |

| ±10% confidence in the time estimate | ±25% confidence in the time estimate | Greater than 25% margin of error assumed in the time estimate |

| The project has no fixed deadline for delivery | The project has a preferred (but not mandated) delivery window | The project must be delivered on or by a fixed date |

Time to deliver is another risk factor.

Projects with short or flexible time frames might be low risk. In contrast, deadline-driven projects or those that span an extended delivery period would be much riskier, as (theoretically, at least) there is more opportunity for things to go wrong.

Once again, a higher degree of confidence in time estimates suggests that things are more likely to go to plan.

The quality of estimates and their impact on project planning are something we will return to with some frequency throughout this course.

| PROJECT SCOPE | ||

|---|---|---|

| LOW RISK | MEDIUM RISK | HIGH RISK |

| We have successfully delivered this project five (5) or more times | We have successfully delivered this project at least once before | We have never successfully delivered a project like this |

Whether or not the organization and/or the key project staff have undertaken this type of project before may also vary by opportunity, option, or project.

A history of successfully delivering similar projects would make an option low risk, which could be contrasted with the high risk of a novel option, or one we have tried and failed to deliver in the past.

| PROJECT IMPACT | ||

|---|---|---|

| LOW RISK | MEDIUM RISK | HIGH RISK |

| Project delivery will noticeably impact one (1) department in our organization | Project delivery will noticeably impact several departments in our organization | Project delivery will noticeably impact most or all, including core service delivery |

| The project has no major precedent or subsequent dependencies | The project has some major precedent or subsequent dependencies | The project has several major precedent or subsequent dependencies |

| Project delivery presents no employee or public health and/or safety risks | Employees/public may be at risk of minor injury or illness during project delivery | Employees/public at risk of serious injury, illness or loss of life during project delivery |

| Project outcomes will fulfil one (1) strategic objective of our organization | Project outcomes will fulfil several strategic objectives of our organization | Project outcomes will fulfil most or all of the strategic objectives of our organization |

Also ask how and to what extent will an option impact the day-to-day operations of the organization.

Are we talking about a single department or all the business’s stakeholders? Will the project interrupt normal service delivery?

The more moving parts a project has, the more stakeholders are affected, and the potential for resistance increases.

Similarly, is the project critically dependent on the successful delivery of other projects or the sensitive contributions of external stakeholders?

In other words, what is out of your control?

And are other projects dependent on yours finishing on time, to budget, and within scope? If so, this might be considered a higher risk to the sponsoring organization than a stand-alone project.

Another risk factor for consideration is the relative health and safety impact a project option might have on our employees or the general public.

Consider, too, the earlier point about the importance of the link between an organization’s strategic objectives, the project, and its outcomes.

A project option that affects or directly relates to key initiatives in the business’s strategic plan may be considered riskier than one with only minor relevance.

| PROJECT STAKEHOLDERS | ||

|---|---|---|

| LOW RISK | MEDIUM RISK | HIGH RISK |

| The project can be fully delivered by our current staff | Some project work will need to be shared with proven, existing partners | The project will depend on collaboration with new and/or unknown partners |

| The project is only of internal interest to our organization | There is likely to be some community interest in the project and/or its outcomes | The project and/or its outcomes will be highly visible in the community |

The extent to which a project can be delivered by our current staff, contractor, and consultant teams will also be risk-relevant.

Projects that venture into new and unknown relationships are less predictable in their performance and should be considered higher risk.

And finally, what level of interest is there in the project from our external stakeholders?

Is the project option of internal interest only, or will it be highly visible in the community?

Will it attract the attention of our regulators?

In the latter cases, there is likely a much greater risk to the performing organization’s brand and reputation should the project under-deliver or fail.

These are some standard options – you may identify more that are specific to your enterprise and its context.

For example, an organizational risk factor for projects delivered on a remote island community could be their level of dependency on imported goods and services.

In that instance, options delivered 100% locally might be considered much lower in risk than those that rely on the vagaries of coastal shipping or air freight.

Another risk factor that could vary by option might be the timing of project cash flows; no doubt you can think of several others that are specific to your own organisational experience.

As always, you should look to develop your own categories, thresholds and definitions of organisational risk.

Risk score

When your organizational risk-assessment criteria are laid out in a matrix, it is a simple exercise to tick the relevant boxes for each option.

You can then assign a risk score to each option; for example, five is high risk, three is medium risk and one is low risk.

The sum of risk scores can then be converted to a percentage for ease of comparison.

| LOW RISK (1) | MEDIUM RISK (3) | HIGH RISK (5) | SCORE | |

|---|---|---|---|---|

| COST | Less than 5% of our program budget | Between 5-15% of our program budget | Greater than 15% of our program budget | 1/5 |

| ±10% confidence in the cost estimate | ±25% confidence in the cost estimate | Greater than 25% margin of error assumed in the cost estimate | 3/5 | |

| Expected costs are fully allowed for in the annual budget or financed by the client | Expected costs are partially allowed for in the annual budget or financed by the client | Expected costs are neither allowed for in the annual budget nor externally financed | 3/5 | |

| TIME | The project can be delivered in less than 3 months | The project can be delivered in less than 6 months | The project will take more than 6 months to deliver | 1/5 |

| ±10% confidence in the time estimate | ±25% confidence in the time estimate | Greater than 25% margin of error assumed in the time estimate | 1/5 | |

| The project has no fixed deadline for delivery | The project has a preferred (but not mandated) delivery window | The project must be delivered on or by a fixed date | 5/5 | |

| SCOPE | We have successfully delivered this project five (5) or more times | We have successfully delivered this project at least once before | We have never successfully delivered a project like this | 3/5 |

| IMPACT | Project delivery will noticeably impact one (1) department in our organization | Project delivery will noticeably impact several departments in our organization | Project delivery will noticeably impact most or all, including core service delivery | 1/5 |

| The project has no major precedent or subsequent dependencies | The project has some major precedent or subsequent dependencies | The project has several major precedent or subsequent dependencies | 3/5 | |

| Project delivery presents no employee or public health and/or safety risks | Employees/public may be at risk of minor injury or illness during project delivery | Employees/public at risk of serious injury, illness or loss of life during project delivery | 1/5 | |

| Project outcomes will fulfil one (1) strategic objective of our organization | Project outcomes will fulfil several strategic objectives of our organization | Project outcomes will fulfil most or all of the strategic objectives of our organization | 1/5 | |

| STAKEHOLDERS | The project can be fully delivered by our current staff | Some project work will need to be shared with proven, existing partners | The project will depend on collaboration with new and/or unknown partners | 5/5 |

| The project is only of internal interest to our organization | There is likely to be some community interest in the project and/or its outcomes | The project and/or its outcomes will be highly visible in the community | 3/5 | |

| TOTAL RISK SCORE: 31/65 = 48% | ||||

It should also be noted that in some cases, it will be a subjective judgment as to whether or not the risk of one criterion is low, medium, or high.

The consensus of key stakeholders should be sought on the final determination, especially where conflict is likely.

Where the project risk profile contains critical economic or other risks, sensitivity analysis should also be performed on those metrics where a change will have a significant effect.

With this information, you can set appropriate low / medium / high risk thresholds for your organization.

For example, a low-risk opportunity might be one with a risk score of less than 40%; a medium-risk opportunity might be 40-70%; and a high-risk opportunity could be one with a score of greater than 70%.

Applying these thresholds to our example above, the opportunity assessed would be categorized as medium risk.

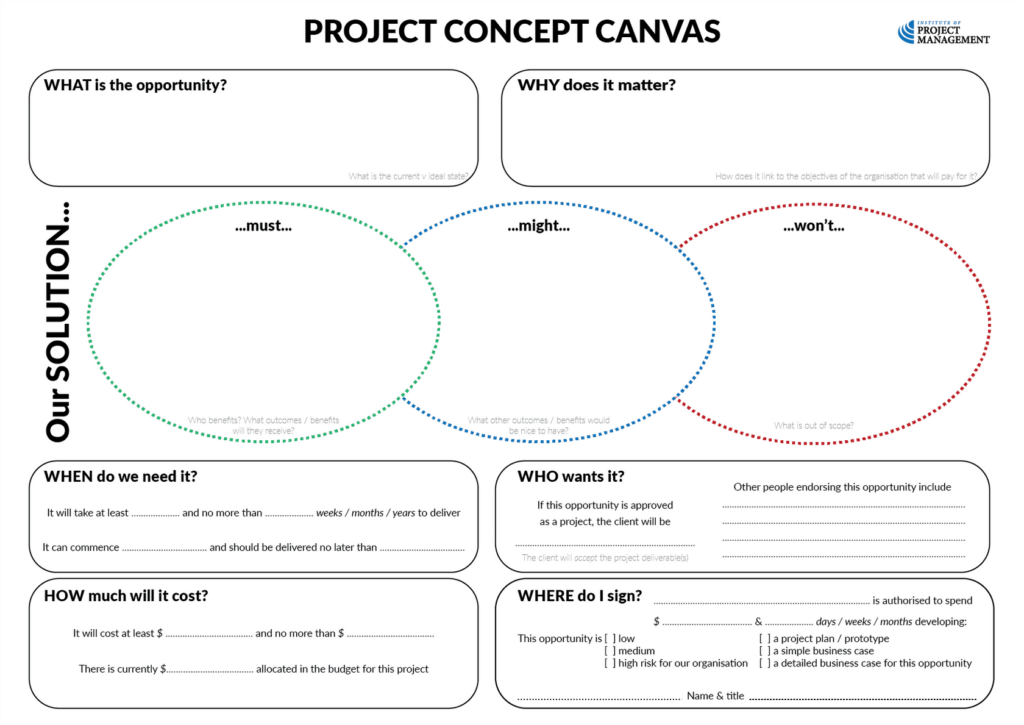

Assuming the opportunity is not deferred or rejected, our concept canvas will now direct us (at the “Where do I sign?” section) to what the next steps in the initiation process should be:

- A high-risk opportunity demands a detailed business case

- A medium-risk opportunity requires a simple business case

- A low-risk opportunity can be immediately chartered and proceed straight to project planning or prototype development.

These subsequent steps are what we introduce in the rest of this unit.

We will return to the risk-profile tool regularly in this course; for now, though, appreciate that this method should be preferred to traditional forms of risk assessment at the project initiation stage.

Click here to download a free, fully editable risk profile tool for your organization.